The Trump administration has been clear about its intentions to cut clean energy incentives, but it would be a massive blow to Republican districts that have benefited from the Inflation Reduction Act, which has supercharged clean energy investments and allowed economic growth in these areas.

The IRA, passed in 2022, included an investment of nearly $370 billion into clean energy incentives, including tax credits on new EV purchases, rebates for energy-efficient home appliances, and tax credits for solar panels and heat pumps.

In Casa Grande, Arizona, these clean energy incentives have led to more local investments and thousands of jobs, which are at risk if the IRA is gutted.

"As much as there are other aspects of the IRA we [Republicans] can disagree with, these tax credits have had an impact in my district — and on job creation, on investment, also national security, because of energy production and having wanted to bring that more domestically," Representative Juan Ciscomani (R-Ariz.), who represents Casa Grande, told Politico.

While Ciscomani has signed a letter urging the House Ways and Means Committee to protect these incentives, the fate of the act is unclear.

Some critics have said that Ciscomani "shows up for the ribbon cuttings and then turns around and cuts funding" to clean energy projects, Politico reported.

But Casa Grande is a prime example of the power of clean energy investments and the benefits of the IRA incentives. Politico reported that Lucid Motors, an electric vehicle manufacturer, has quadrupled its operations in the town and added nearly 3,000 "life-changing" jobs since its inception.

While the plant was planned before the IRA was passed, it benefits from the tax credits in the act.

Beyond Casa Grande, IRA incentives have led to major growth in clean energy investments, which have amounted to $1 trillion in the past six years, according to RMI.

The nonprofit reported that the IRA led to a tripling in quarterly clean energy technology investments since its passage, with Republican states receiving 64% of those investments. Across the aisle, it makes economic sense to maintain the IRA benefits.

|

Should the government continue to give tax incentives for energy-efficient home upgrades? Click your choice to see results and speak your mind. |

A good way to communicate your support for clean energy initiatives is to show companies and elected officials that green business is good business.

If you want your financial decisions to align with your values, GreenPortfolio connects individuals with remote financial advisors who make climate-forward investing simple.

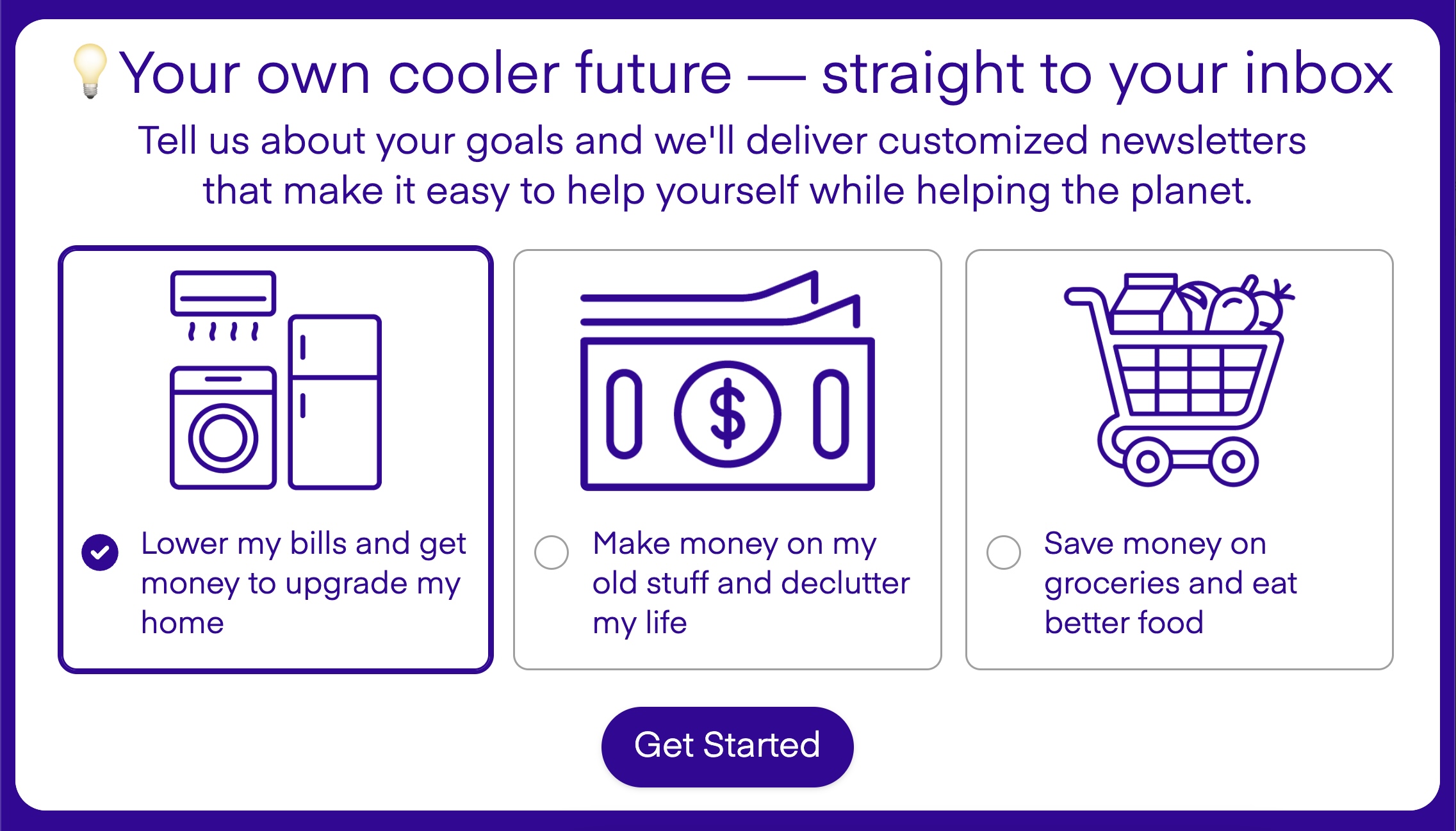

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.